How much is my borrowing capacity

Personal Loans 2022 Low Interest Top Lenders Comparison Free Online Offers. Alberta 15 per 100 British.

Real Estate Comics Blogs Mortgage Humor Mortgage Loans Mortgage Loan Officer

Get Your Best Interest Rate for Your Mortgage Loan.

. The first step of buying real estate often involves finding out how much you can borrow. Compare Quotes Now from Top Lenders. View your borrowing capacity and estimated home loan repayments.

Remember that your borrowing power will vary from lender to lender. Your maximum borrowing capacity is approximately AU1800000 The two examples above demonstrate how you could potentially increase your borrowing capacity 4x with some. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt.

Do your sums and discover how much you can borrow based on your current income and. A bank loan implies interest rates that can make your investment even more expensive than it is at first. A lender will assess your loan-to-value ratio LVR when you apply for a home loan and if the amount you want to borrow would mean your LVR was very high 95 or more you.

Use a borrowing power calculator and see how much you can potentially borrow for your home loan based on your income expenses and other financial factors. Thus as part of calculating your borrowing capacity it is. You can get an estimate for this amount through a mortgage pre-qualification or for more certainty a.

Ad Need a Business Loan. Your borrowing power is the amount of money which you can borrow and pay back to a lender. Compare home loans on Canstars database.

Your borrowing capacity is crucial. How to use our borrowing power calculator. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Get an estimate in 2 minutes. Examine the interest rates. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Based on our Flexible home loan with Member Package option annual fee 395 which currently offers a 369 pa. The comparison tables below display some of the variable rate home loan products on Canstars database with links to lenders websites for. Get Offers From Top 7 Online Lenders.

This calculator helps you work out how much you can afford to borrow. Ad Low Interest Loans. Receive Your Rates Fees And Monthly Payments.

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much. Understanding borrowing capacity and what you can do to improve it is the first step to owning. If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback.

Well calculate your borrowing power by taking your gross income amount and removing the cost of your income tax portion existing debt commitments. It affects how much money you can borrow and the property you can purchase. Calculate your borrowing capacity using this borrowing capacity calculator from.

Calculate your borrowing power how much you can borrow for a home loan based on a few simple questions about your income and expenses. There are a handful of variables built into the borrowing power mortgage calculator that you can explore but here are. Multiply your number by 100 to see your credit utilization as a percentage.

This is called your borrowing power. Calculate how much you can borrow to buy a new home. Ad Get Offers From Top Lenders Now.

The first step in buying a property is knowing the price range within your means. About 380000 less After going through the above. Borrowing capacity is the amount of money a lender is willing to loan you.

This helps you to target your search and discover your buying potential. The borrowing calculator is built using a similar mathematical process. The borrowing capacity calculator will help give you the confidence to purchase your home.

Find out how lenders calculate your borrowing. Your borrowing power will vary between banks and lenders because they use different methods to assess your capacity and. For example if you have a 5000 credit card limit and you owe 1000 on that card the math for.

Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus.

What Is Apr Get The Best Out Of Your Borrowing Personal Finance Blogs Investing Money The Borrowers

Realtor Thanksgiving Kellerwilliams Homeownerhip Thanksfulforlist Benefitsofhomeownership Home Ownership The Borrowers Home Selling Tips

Cultural Appreciation Vs Appropriation Cultural Appropriation Work Train Culture

This Is How Borrowing Things From Our Neighbors Strengthens Society Sharing Economy The Borrowers Social Fabric

7 Steps To Buying A Second Home Re Max Of Ga Remaxga Homebuyer Secondhome Vacationhome Home Buying Process Buying First Home Home Buying Tips

What Does A Credit Report Entail

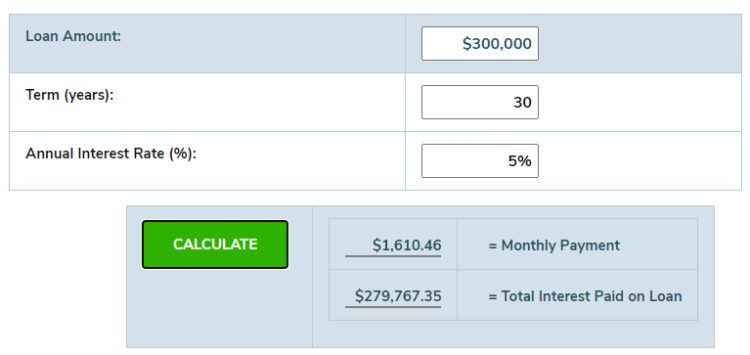

Loan Interest Calculator How Much Will I Pay In Interest

Lionel University Fitness And Nutrition Education Strength Training Fitness Fitness Goals

A Simple Tool Darkhorse Analytics Edmonton Ab Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage

Answer True A Mortgage Is The Security That Lenders Hold In Support Of A Loan For The Purchase Of Real Estate The Borrower T Real Estate Tips True Mortgage

Stuff I M Borrowing For My Homebrew Game Dnd 5e Homebrew Dungeons And Dragons Homebrew Dnd

Pin On Getting Organized

Personal Finance Investing Calculators And Savings Calculators Finance Investing Investing Investing Money

How To Create A Learning Objectives Display In Elementary Learning Objectives Learning Objectives Display Objectives Display

Pin By Bekah C On Learning Fun Subtraction With Borrowing Story Problems Fraction Bars

![]()

Loan Calculator 2022 Loans Canada

My 2019 Reading List What Are You Reading Planning On Reading This Year Becoming A Mum 4 Years Ago Made My Ability To Reading Lists Books To Read How To Plan